Did you know there’s a great way to make a gift to Clean Water Fund and benefit on your taxes without having to file a long, complicated itemized return?

Give a gift directly from your IRA!

Download the How-To Guide Here!

Recently, more and more of our members have been using Individual Retirement Accounts (IRAs) to make donations to Clean Water Fund. Maybe you’ve already heard something about it, but you’ve got some questions. Are IRA donations really a smarter way to give? How does it work? Who is eligible? When is the best time to do it? And what are the potential pitfalls?

These are all great questions. We’ve heard most of them by now, from members just like you.

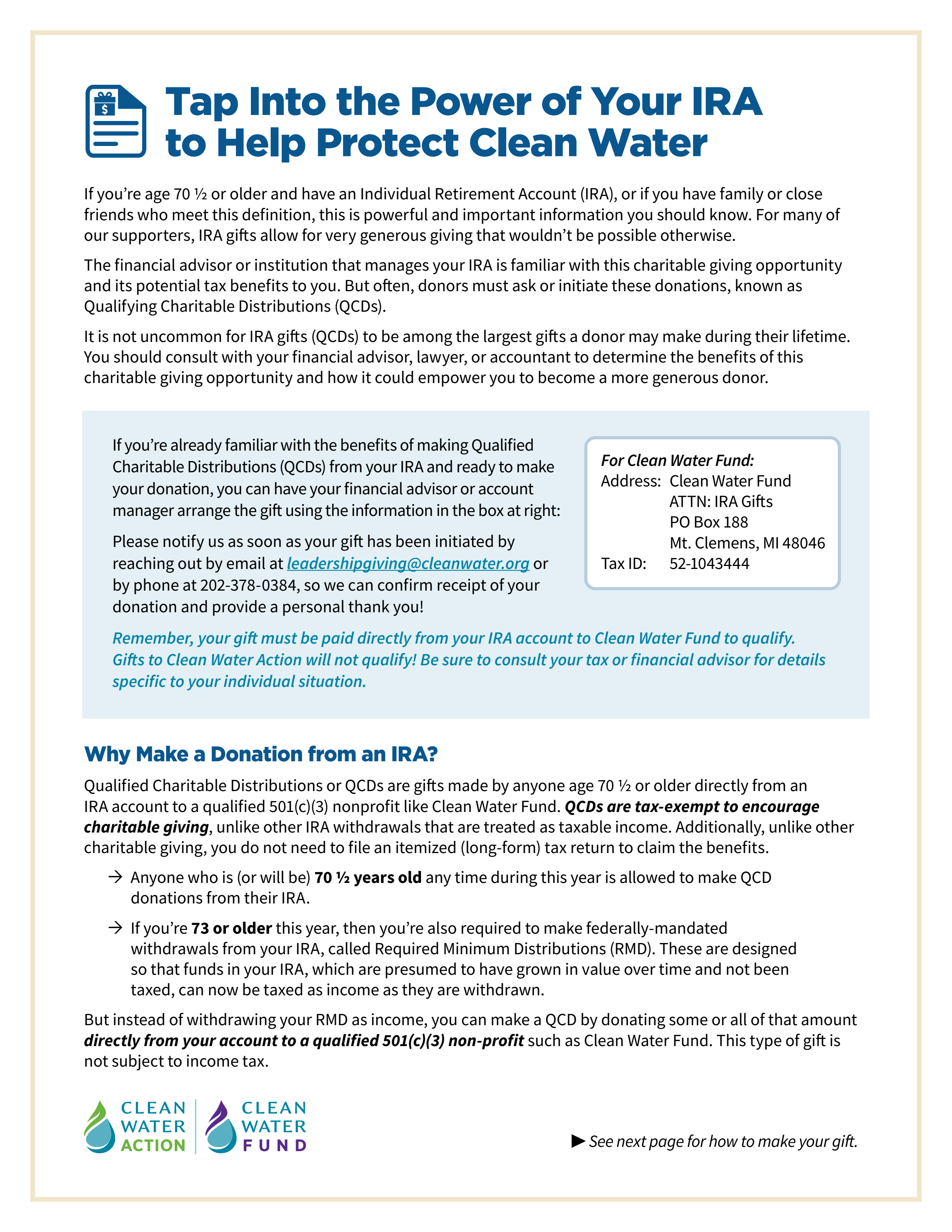

Already familiar with Qualified Charitable Distributions (QCDs) and ready to make your donation? You can have your financial advisor or account manager arrange the gift using the information below.

| Clean Water Fund | |

| Mailing Address: | Clean Water Fund ATTN: IRA Gifts PO Box 188 Mt. Clemens, MI 48046 |

| Tax ID: | 52-1043444 |

Here’s what you need to know:

WHO? Anyone age 70 ½ or older with a traditional IRA (Individual Retirement Account), especially anyone turning 73 or older this year – the age at which IRA withdrawals become mandatory and taxable.

WHAT? Qualified Charitable Distributions or QCDs are gifts made by anyone age 70 ½ or older directly from their IRA account to a qualified 501(c)(3) nonprofit like Clean Water Fund. QCDs are tax-exempt to encourage charitable giving, unlike other IRA withdrawals that are subject to federal income tax.

WHY? Anyone who meets these age requirements and follows the steps to make an IRA gift correctly can potentially realize tax benefits from their gift. Unlike other charitable giving, you do not need to file an itemized (long-form) tax return to claim the benefits. This makes IRA gifts especially well suited for a wider range of people.

WHEN? To count for the current tax year, your QCD should be received by December 31. But there can be advantages to making your gift earlier in the year! See our in-depth guide for more information.

HOW? Simply direct your retirement fund administrator or financial firm to send your IRA gift directly to Clean Water Fund, a qualified 501(c)(3) nonprofit. (Withdrawing the money from your IRA and then writing us a check will not qualify as a QCD – see our guide for more details.)

HOW MUCH? The cap on QCDs adjusts annually to account for inflation. For example, in 2026, your IRA gift can be any amount up to $111,000, or $222,000 for couples filing jointly.

ANYTHING ELSE? Please note that to qualify as a tax-exempt QCD, your gift must be made to Clean Water Fund. Gifts to Clean Water Action will NOT qualify.

Please see our detailed guide to get more information, including important potential pitfalls that you should avoid.

Let us know if you have questions or need help arranging an IRA gift. We’re here to help.