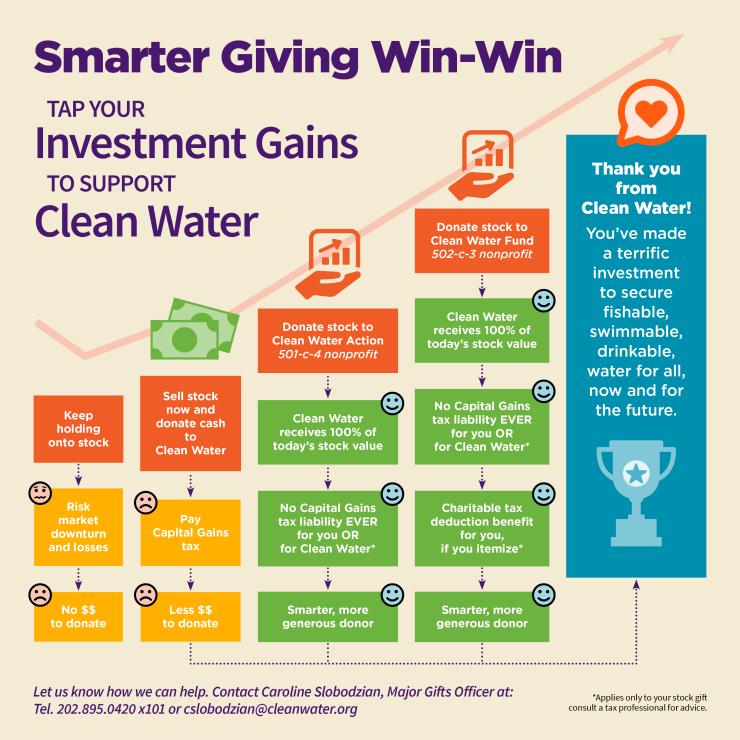

There are lots of ways to show your support for Clean Water Action and Clean Water Fund.

But one of the smartest ways is to donate stock. Because, if you hold onto stock, you risk market downturns and losses. Or, if you sell stock and donate to Clean Water Action or Clean Water Fund, you may pay a capital gains tax and have less money to donate.

Donating stock is a win-win for you, and Clean Water.

If you donate stock to Clean Water Action (501-c-4 nonprofit)*

- Clean Water Action receives 100% of today’s stock value

- No capital gains tax liability for you or for Clean Water Action (applies to your gift only)

- This makes you a savvier, more generous donor.

If you donate stock to Clean Water Fund (501-c-3 nonprofit)*

- Clean Water Fund receives 100% of today’s stock value

- No capital gains tax liability for you or for Clean Water Fund (applies to your gift only)

- Charitable tax deduction benefit for you (if you itemize)

Whether you donate stock to Clean Water Action or Clean Water Fund, you are a savier, more generous donor.

Let us know how we can help. Contact Caroline Slobodzian, Major Gifts Officer at: Tel. 202.895.0420 x101 or cslobodzian@cleanwater.org

*Consult your tax professional for advice.

Stay Informed

Get the latest updates and actions:

Thanks for signing up!

There was a problem processing your signup. Please try again.